VAT Registration in The UAE Services

The UAE government implemented a Value Added Tax (VAT) Act on January 1, 2018 to a variety of commodities throughout the nation at an average rate of 5%. Businesses in the UAE may take advantage of VAT registration to recoup some of the cost of this new tax.

In regards to VAT, we’ve received many questions. Listed below are some of the most frequently asked questions..

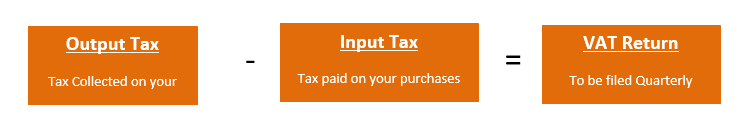

Indirect taxes are levied on commodities in the form of Value Added Tax, which can be compared to the type of universal consumption tax imposed on the consumption of goods and services. It is a comprehensive multistage consumption tax levied across the supply chain and collected by companies on behalf of the government. VAT is in the long run borne by the customer, who is the end user, rather than the firms.